Article on fiscal horses and fiscal power of vehicles

Article on fiscal horses and fiscal power of vehicles

Introduction

Welcome to our article on fiscal horses and fiscal power of vehicles. In this text, we will address all the doubts and concerns you may have about this topic. From how to calculate the tax horsepower to the regulations governing the Tax on Mechanical Traction Vehicles (IVTM), you will find all the information you need to understand this fundamental aspect in the automotive field.

What are tax horses and how is the tax horsepower of a vehicle calculated?

Let's start by understanding what tax horsepower is and how the tax horsepower of a vehicle is calculated. Tax horsepower is a unit of measure used to determine the power of a vehicle for tax purposes. In Spain, this value is used to calculate the Tax on Mechanical Traction Vehicles (IVTM).

Fiscal horsepower is calculated from engine displacement and other factors such as number of cylinders and vehicle power. There are different formulas to perform this calculation, but one of the most common is the following:

Fiscal power = (Cylinder capacity x Number of cylinders) / 2

It is important to take into account that each autonomous community may have its own regulations and calculation coefficients, so it is advisable to consult the current legislation in each case.

Calculators and useful tools

If you are looking for a calculator that allows you to determine the fiscal horsepower and fiscal power of a vehicle, there are several options available. Two of the most popular are those offered by Swipoo and Seis Línea. These tools will allow you to obtain the results quickly and easily, thus facilitating the calculation of the fiscal power of your vehicle.

Also, if you need to convert the power of a vehicle from KW to HP and vice versa, you can also find online calculators that will help you with this task. These tools are especially useful if you are comparing vehicles from different countries, as power is expressed differently in each country.

Tax on Mechanical Traction Vehicles (IVTM)

The Tax on Mechanical Traction Vehicles (IVTM) is a tax levied on the ownership of vehicles suitable for driving on public roads. This tax is calculated based on the fiscal power of the vehicle and may vary according to the regulations of each autonomous community.

If you wish to obtain more information about the IVTM and how to calculate it, we recommend that you consult the legislation in force in your autonomous community. In addition, the Tax Agency can provide you with additional information on the tax valuation of the vehicles and the procedures necessary for the payment of this tax.

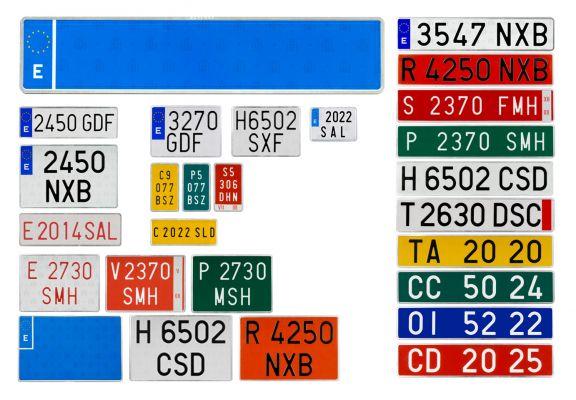

Vehicle regulations and classification

If you are interested in accessing the Provincial Regulation 7/1989, which regulates the Vehicle Tax, we recommend that you consult the official website of your autonomous community. There you will find all the necessary information about the current regulations and the procedures for paying the tax.

On the other hand, if you want to know the classification of vehicles according to their fiscal power, it is possible that the Barcelona City Council provides information in this regard. We suggest you visit its official website to obtain updated information on this subject.

Frequently Asked Questions

1. What is the difference between fiscal horsepower and horsepower?

Fiscal horsepower and horsepower are two different concepts. Fiscal horsepower is a unit of measurement used to calculate the Tax on Mechanical Traction Vehicles (IVTM), while horsepower is a measure of the actual power of a vehicle's engine. The power of a vehicle is expressed in horsepower (CV) or kilowatts (KW) and is related to its performance and acceleration capacity.

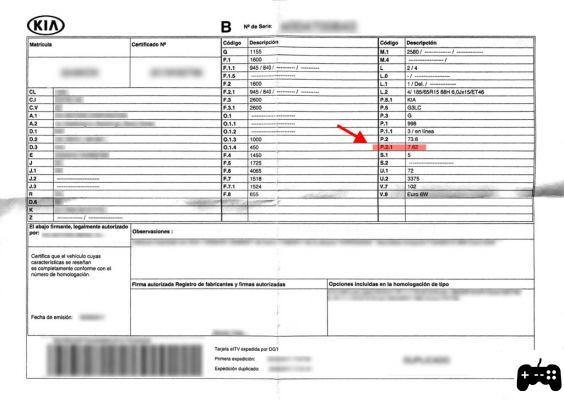

2. How can I find out the fiscal power of my vehicle?

To find out the fiscal power of your vehicle, you can consult its technical data sheet. In this document you will find all the relevant information about the technical characteristics of the vehicle, including the fiscal power. If you do not have the technical sheet, you can request it from the manufacturer or dealer where you purchased the vehicle.

Conclusion

In summary, the tax horsepower and the tax power of a vehicle are fundamental aspects to take into account both for the calculation of the Tax on Mechanical Traction Vehicles (IVTM) and to know the performance and acceleration capacity of a vehicle. We hope that this article has been useful and has resolved all your doubts in this regard. Remember to consult the legislation in force in your autonomous community and use the tools available to make the necessary calculations. Until next time!